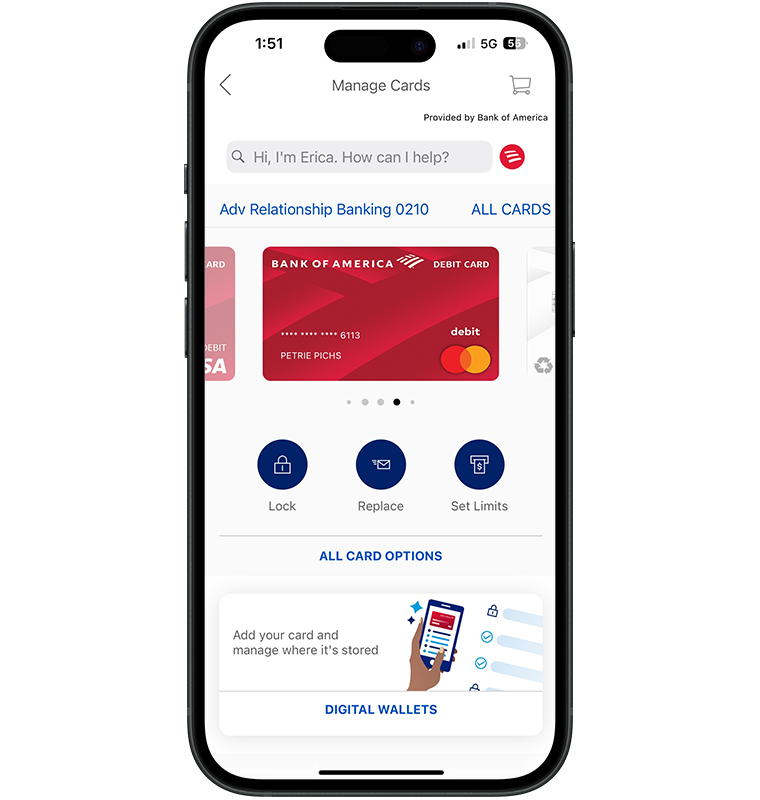

Learn more about OTA payment models and scenarios from our article on travel payment integrations for resellers. Still not common for end consumers, the approach gained traction in business-to-business relationships, particularly in fleet management and B2B travel sales.Īmong the main beneficiaries of the method are travel management companies (TMCs) and OTAs who act as a merchant of record - in other words, accept payments of end travelers before distributing money across suppliers. Their creator, the Irish payment processing company Orbiscom was later acquired by Mastercard. Virtual cards appeared as a new anti-fraud measure at the end of the 1990s. And since the VCC has a lot of restrictions and becomes invalid once the charge is made, its exposure to fraud is relatively small. But in any case, a hotel will never know the guest’s credit card information. Besides, the flow can largely vary depending on the type of virtual card provider, conditions negotiated with a supplier, and many other things. Of course, this scenario is very rough, with many details missing. The VCC automatically expires once the transaction is completed.The hotel charges the VCC instantly, after check-in or on check-out - depending on the cancelation policy and agreements with the OTA (for instance, activates its VCCs one day after check-in.The OTA pushes the VCC representation along with booking confirmation to the hotel via API or email.The virtual card provider returns a 16-digit VCN, CVC code, and expiration date substituting the guest’s credit card details.The OTA forwards payment details via API to a virtual card provider, initiating issuance of a virtual card with certain settings - such as a restricted amount of money (for example, a hotel can charge no more than a negotiated room rate - in our case, it will be $100 minus OTA commissions).The OTA authorizes the payment with its acquiring bank.A traveler books a room for two nights via OTA and provides credit card information to pay $100 for the stay.How a payment process with VCCs may look like. To better understand the protection mechanism, let’s look into one of the possible flows where an online travel agency (OTA) uses a virtual credit card (VCC) to pay the price of a hotel room. other scenarios with a combination of restrictions.payments to a specific supplier or category of suppliers (for example, only hotels or only airlines), and.multiple transactions within a restricted timeframe (say, for the period of the business trip only).a single transaction or a particular purchase, with a limited amount to be spent.

The main selling point of a virtual card lies in enhanced security and control over spending. Each time, a virtual card comes with a unique 15- or 16-digit virtual card number (VCN) and expiry date, ceasing to function when its goal is achieved. What are virtual cards?Ī virtual card in B2B transactions is a payment option linked to a real card account and typically issued to pay a specific amount of money in a desired currency to a particular recipient. This article explores the benefits virtual cards bring to the table and what a travel company should consider when implementing this method. About 71 percent of this volume will come from B2B financial interactions, including those done in travel.

Virtual cards are launched: What’s next? Reading time: 12 minutesĪ study by Juniper Research revealed that the value of virtual card spending will hit $6.8 trillion in 2026, a 370 percent increase from 2021.

BANK OF AMERICA VIRTUAL CREDIT CARD NUMBER HOW TO

How to choose the right virtual card partner.

0 kommentar(er)

0 kommentar(er)